Corporate Carbon Strategies: Act Now or Pay Later

- Izzy Jensen

- Sep 5, 2024

- 4 min read

In the race against climate change, forward-thinking companies like TotalEnergies are securing their future by investing in carbon credits today. With demand set to outstrip supply by 2030, corporations must act now or risk being left behind in the transition to a low-carbon economy.

TotalEnergies' recent $100 million investment in U.S. forestry projects isn't just another corporate sustainability initiative—it's a strategic move that sets a new standard for environmental responsibility in the energy sector. The investment, which will support 20 carbon projects covering nearly 750,000 acres in 10 U.S. states, is part of TotalEnergies' broader strategy to offset its greenhouse gas emissions. This approach is not just about ticking boxes; it's a pragmatic recognition that while emissions reduction is crucial, some level of emissions will likely persist in the foreseeable future. This proactive approach highlights a crucial reality: companies that delay action on carbon offsetting will face higher costs and limited options in the future.

The Looming Supply Crunch

Multiple studies from leading consulting firms paint a stark picture of the carbon credit market's future: McKinsey projects that demand for carbon credits could increase by a factor of 15 or more by 2030 and by a factor of up to 100 by 2050. Bain & Company forecasts that demand could outstrip supply by 400-800 million tons of CO2 equivalent by 2030.

These projections underscore a critical message: the window for securing high-quality, affordable carbon credits is closing rapidly.

A Comprehensive Strategy

TotalEnergies' proactive stance is particularly noteworthy when we consider the company's long-term commitment. They have pledged to invest $100 million annually to build a portfolio of projects capable of offsetting at least 5 million metric tons of CO2 annually by 2030. This foresight is commendable, especially when contrasted with the reactive approaches of many other industry players.

The company's strategy aligns with global trends in energy demand. Recent forecasts, such as Exxon Mobil's projection that oil demand in 2050 will match today's levels, underscore the ongoing relevance of traditional energy sources. While we must strive for a low-carbon future, it's equally important to address the reality of continued emissions in the interim.

TotalEnergies aims to reduce its net Scope 1 + 2 emissions from operated activities by at least 40% by 2030, compared to 2015 levels

TotalEnergies' approach is multifaceted and well-considered:

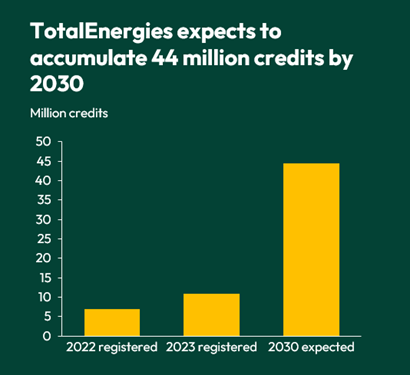

Early Investment: The company is building a portfolio of credits expected to reach 44 million by 2030 and 71 million by 2050. By securing high-quality carbon credits now, TotalEnergies is mitigating against future price increases and potential scarcity.

Diverse Portfolio: The company is investing globally, spreading risk and maximising impact across various ecosystems. Investments in forestry, regenerative agriculture, and wetlands protection balance environmental benefits with local economic development.

Long-term Planning: A commitment of $100 million annually, with a cumulative budget of nearly $725 million over project lifespans. With a focus on 2030 and beyond, TotalEnergies is demonstrating strategic foresight often lacking in corporate climate initiatives.

Tangible Environmental Benefits: Beyond carbon sequestration, these projects contribute to biodiversity protection and habitat conservation.

Critics might argue that such investments merely allow companies to continue polluting. However, this view oversimplifies a complex issue. While reducing emissions must remain the primary goal, offsetting residual emissions through high-quality carbon projects is a necessary complementary strategy. TotalEnergies' approach doesn't replace emissions reduction efforts; it supplements them.

TotalEnergies expects to accumulate 44 million credits by 2030.

The Urgency for Corporate Action

The contrast between TotalEnergies' approach and that of some other companies is stark. In Australia, the Clean Energy Regulator earlier this year had to write to Safeguard facilities, expressing concerns that some had not finalised their procurement strategies for carbon credits. The regulator also warned of insufficient supply in the Cost Containment Reserve to meet Australian Carbon Credit Unit (ACCU) shortfalls and cap prices. This reactive stance puts these companies at a significant disadvantage.

Companies delaying action face several risks:

Higher Costs: As demand outstrips supply, prices for high-quality credits will inevitably rise.

Limited Options: The best projects and highest quality credits will be secured by early movers.

Regulatory Pressure: Governments are likely to impose stricter requirements, potentially leaving unprepared companies scrambling to comply.

Reputational Risks: As climate action becomes a key metric for stakeholders, laggards may face public and investor backlash.

Call to Action

The message is clear: corporations cannot afford to wait until 2030 or 2050 to act on their climate commitments. The time to invest in high-quality carbon credits is now. By following TotalEnergies' lead and taking a proactive, strategic approach to carbon offsetting, companies can:

Secure a supply of high-quality credits at current prices

Contribute to immediate climate action while developing long-term emissions reduction strategies

Position themselves as leaders in corporate sustainability

Mitigate future regulatory and reputational risks

As the global community races to achieve net-zero emissions, the companies that act decisively today will be the ones best positioned for success in the low-carbon economy of tomorrow. The question for corporate leaders is no longer whether to invest in carbon credits, but how quickly they can develop and implement a comprehensive strategy to do so.

Comments